What is the Opportunity Zone Program?

The 2017 Tax Cuts and Jobs Act provides powerful new tax incentives for private investment

in businesses and real estate in certain communities called “opportunity zones.“

The act encourages investment in job creation and real estate opportunities such as

mixed-income housing.

Investors can plow recently realized capital gains into opportunity zones... erase a portion of those tax gains and, more significantly have those proceeds grow tax-free.

- Forbes, Break & Build, July 18, 2018

What is the goal of the program?

To incentivize private individuals and companies, that may be sitting on the sidelines with capital gains, to directly invest in Opportunity Zone Funds that can help investors achieve both favorable tax treatment and additional investment returns.

After tax net return on $1M investment1

How does it work?

What does an average Opportunity Zone look like?

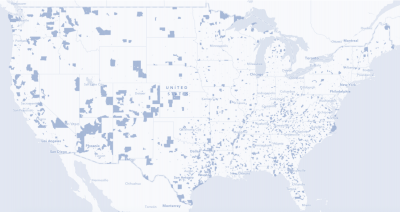

- 8,700 Different Opportunity Zones located in all 50 states, and DC

- 35 million people live in Opportunity Zones

- +75% certified zones lie within metropolitan areas

- 24 million jobs and 1.6 million places of business reside within Opportunity Zones today

Click below for an inactive map of all Opportunity Zones in the U.S.

Frequently Asked Questions

The tax legislation enacted in December 2017, called the Tax Cuts and Jobs Act of 2017, included a new tax provision designed to encourage investment in certain emerging communities – designated as QOZs – by allowing capital gains recognized prior to December 31, 2026 to be deferred and possibly reduced.

As identified by each state’s governor, there are over 8,700 QOZs in the US and its territories. While each QOZ had to meet certain economic thresholds, the data used to determine such eligibility is based on the 2010 census.

If an individual sells any property (e.g., stock, partnership interest, etc.) to an unrelated person before December 31, 2026 that generates a long-term or short-term capital gain, and invests an amount equal to or less than the total capital gain amount into a QOF within 180 days beginning on the date of such sale, then the individual may have the ability to receive various tax benefits.

Starting in 2021, eligible gains can be invested on a rolling annual basis.

June 28, 2022 — Eligible capital gains recognized on December 31st, 2021 must be invested by this date.

December 31, 2026 — Deferment on original gain ends, and gain is recognized.

April 15, 2027 — Income taxes for 2026 are due. This includes tax payments due on your original deferred gain.

2028 — The first year in which some of the earliest Opportunity Zone investments may be sold and qualify for the 10-year gain exclusion.

December 31, 2028 — Expiration of the designation of Qualified Opportunity Zones. QOZFs may still be active after this date to receive the 10-year exclusion. Expiration should not have any effect on receiving this incentive.

June 28, 2037 — The earliest date on which the last Opportunity Zone investments may be sold and qualify for the 10-year gain exclusion. Applies to 2026 through June 28, 2027, deferred gains that were invested into a QOF.

10-year gain exclusion also starts ending on this date for deferred gains invested into QOZF from 2026 through June 28, 2027. If held for 10 years, those investments can now be sold.

December 31, 2047 — The ability to eliminate gains on a taxpayer’s QOF investment could cease upon the expiration of QOZ designations.

Deferral (“Deferral Benefit”)

Tax on the original capital gain is not recognized immediately, and is deferred until the earlier of December 31, 2026 or the sale or other disposition of the QOF interests.

Reduction (“Reduction Benefit”)

Original capital gains may be reduced up to 15% based on when the QOF investment was made and how long the taxpayer holds the investment:

- If invested prior to December 31, 2021 and held for 5 years, the original capital gain is reduced by 10% (i.e., a 10% investment cost basis step-up).

- If invested prior to December 31, 2019 and held for 7 years, the original capital gain is reduced by an additional 5% (i.e., an additional 5% investment cost basis step-up for a total of a 15% investment cost basis step-up).

Note that the tax liability on the remaining original capital gain investment must be paid in 2027, whether or not the taxpayer has sold the interest in the QOF.

Elimination (“Elimination Benefit”)

If the interest in the QOF is held for at least 10 years (and disposed of prior to December 31, 2047)), the capital gain on the appreciation in the QOF investment (assuming there is appreciation) is eliminated (i.e., never taxed). Under current guidance, this benefit is available when the QOF interest is sold. Proposed tax regulations released in April 2019 would permit investors in a QOF treated as a partnership, S corporation or REIT to exclude capital gain from the QOF's sale of its underlying assets, but these provisions cannot be relied on currently and present some uncertainties.

In order to qualify for QOZ tax benefits, a taxpayer must invest up to the amount of eligible capital gains from a sale or exchange of an investment into a QOF within 180 days of the sale of the investment.

- Note that solely committing capital to a QOF within 180 days of the sale of the investment will not satisfy the 180 day A taxpayer must invest the proceeds from the gain into the QOF (i.e., capital must be drawn) in order to satisfy the 180 day requirement.

Eligible gains include long-term or short-term capital gains from sales of real estate and non-real estate investments, including stocks, bonds and other publicly traded securities. Capital gains that are allocated to a partner in a partnership are eligible as long as the partnership itself does not make an election to defer the capital gain.

- For individual investment sales, the 180-day period begins on the trade

- For a capital gain recognized by a partnership, as long as the partnership does not elect to defer the gain, the 180-day period can either begin on the last day of the partnership’s taxable year OR can begin on the trade date related to the partnership’s capital

Note that only the capital gain from the sale of an investment is eligible for the QOZ tax benefits offered by the legislation. Amounts invested in a QOF that do not correspond to capital gains, such as the return of capital on the investment whose gains are rolled over into the QOF, are not eligible to receive the QOZ tax benefits.

There is no guarantee that a QOF will generate any proceeds to pay for the 2026 tax liability, payable in 2027. Therefore, taxpayers should ensure that they will have other amounts available to pay their tax liability.

In general, eligible gains are measured on a gross basis. Taxpayers do not need to determine their net capital gains to assess how much is available to invest in a QOF.

However, there are a few exceptions:

- Only net capital gains from section 1256

- Only net capital gains from section 1231 property (under section 1231, net gain from sales of property used in a trade or business is treated as capital gain, while net loss from such property is treated as ordinary)

- Under current guidance, a capital gain is not eligible for deferral if it is from a position that is or has been part of an offsetting-positions transaction (offsetting-position is defined as a transaction in which a taxpayer has substantially diminished the risk of loss from one position with respect to personal property by holding one or more other positions with respect to personal property, whether or not of the same kind).

It is expected that interim cash flows produced by QOF assets would be distributed and taxed as appropriate, similar to most real estate private equity funds. Any business income generated by the QOF’s properties will be taxed at ordinary income rates. Since most QOF managers will be implementing a build- to-core strategy, the properties are expected to be stabilized shortly after the construction period for each, which is typically 2-3 years.

To qualify as a QOF, a partnership or corporation must hold at least 90% of its assets in “eligible QOF investments,” which are discussed in the next section. The 90% test is measured as the average of the percentages of the assets on two testing dates each year. There is an initial testing date 6 months after electing to be a QOF and then subsequent testing dates are at the mid-point and end of each taxable year (June 30th and December 31st for a calendar year QOF). A QOF may apply the 90% test without taking into account contributions received in the six months preceding the testing date, provided that the new assets are continuously held in cash, cash equivalents or debt instruments with a term of 18 months or less (“Working Capital Assets”).

An asset is considered to be substantially improved if additions to its basis made within 30 months of acquisition exceed the adjusted tax basis of the asset at acquisition. Per guidance issued pursuant to the QOZ legislation, the basis of a building acquired on land in a QOZ includes only the basis of the building, and not the land, with there being no independent requirement to improve the land.

While there are no tax prohibitions on the transfer of a QOF interest (certain restrictions may be imposed by the investment sponsor), a sale or disposition of a QOF interest prior to December 31, 2026 can trigger the recognition of deferred gain by the transferor (also known as an inclusion event). A disposition can include a gift, charitable transfer, bequest or corporate/partnership transaction that reduces or terminates the owner’s QOF investment. For instance, a transfer, including an otherwise “tax-free” transfer (such as a contribution to a controlled corporation), may trigger the deferred gain.

- Lifetime Transfers - A transfer by gift (including a charitable gift) will trigger recognition of the deferred gain unless the gift is made to a so-called grantor trust (for which the original investor is considered the owner). A subsequent transfer out of such trust or a change in grantor trust status, however, would be treated as a disposition and trigger the deferred gain, unless the transfer (or termination of grantor trust status) is by reason of the grantor’s

- Testamentary Transfers - A transfer by reason of death also terminates the original owner’s QOF investment, but such a transfer to a beneficiary (or by operation of law) will not trigger the deferred Therefore neither a transfer of the QOF investment to the deceased owner’s estate nor the distribution by the estate to the decedent’s legatee or heir is a taxable event.

As long as the transfer does not trigger the deferred gain, the recipient of the QOF investment may include the original donors (or decedent’s) holding period when determining if the investment has been held 5, 7 or 10 years, otherwise it will reset the holding period for any or all of the QOF Program benefits.

A sale or transfer of a QOF interest after December 31, 2026, has no effect on deferred gain (since it will have been previously recognized), but could be a taxable transaction if it takes place before the QOF investment has been held for 10 years.

QOF investments included in a decedent’s estate do not receive a step-up in basis with respect to any of the gain that was originally deferred, other than the potential 10% and 5% adjustments. If the date of death value of the QOF exceeds the originally deferred amount, the QOF investment should be stepped- up only for such appreciation. Therefore, if a QOF owner dies before December 31, 2026, then his or her estate or beneficiary would receive the QOF investment without a full step-up in basis to its then value. This would result in the estate or beneficiary having to recognize the deferred gain on December 31, 2026 (or earlier, if disposed of), subject to the usual 10% and 5% potential basis adjustment under normal QOF rules. There may be no liquidity from the QOF investment to satisfy the tax liability.

Footnote

- $1 Million investment assuming a 7% annual appreciation, and a hold period of 10 years, when compared to a traditional portfolio with the same return. The above hypothetical example is not indicative of the fund’s return, and there are no assurances that the fund will meet the example above. Past performance is not indicative of future results. Future returns are not guaranteed. A loss of principal may occur.

Contact our firm to learn more about how you can take advantage of opportunity zones.